All Categories

Featured

Table of Contents

[/video]

You can underpay or miss premiums, plus you may be able to adjust your fatality benefit.

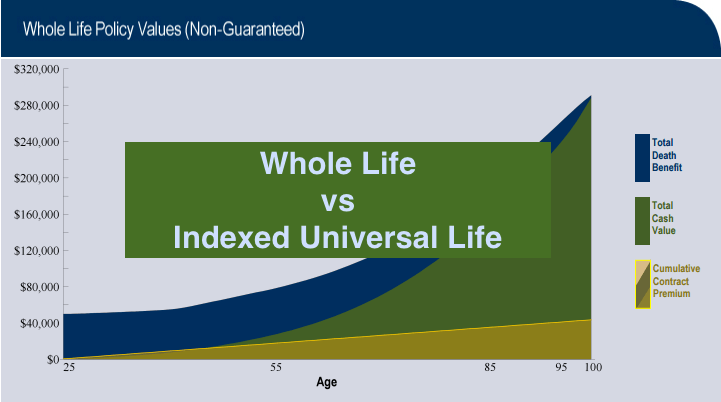

Cash money value, along with potential growth of that value with an equity index account. A choice to designate part of the money worth to a fixed interest choice.

Www Iul

Policyholders can decide the percentage alloted to the dealt with and indexed accounts. The worth of the picked index is videotaped at the start of the month and compared to the worth at the end of the month. If the index boosts throughout the month, interest is included to the cash money worth.

The 6% is multiplied by the money worth. The resulting interest is contributed to the cash money value. Some plans calculate the index acquires as the amount of the adjustments for the duration, while other plans take approximately the day-to-day gains for a month. No interest is attributed to the money account if the index drops rather of up.

Iul Account

The rate is set by the insurer and can be anywhere from 25% to greater than 100%. (The insurance firm can additionally alter the participate rate over the life time of the plan.) If the gain is 6%, the participation rate is 50%, and the current cash money worth total amount is $10,000, $300 is added to the cash worth (6% x 50% x $10,000 = $300).

There are a variety of advantages and disadvantages to consider before purchasing an IUL policy.: Just like basic universal life insurance policy, the insurance holder can increase their premiums or reduced them in times of hardship.: Quantities attributed to the money value grow tax-deferred. The cash money worth can pay the insurance policy costs, permitting the insurance holder to lower or stop making out-of-pocket costs repayments.

Lots of IUL policies have a later maturity day than other sorts of universal life plans, with some finishing when the insured reaches age 121 or even more. If the insured is still active during that time, policies pay out the fatality advantage (yet not usually the money worth) and the earnings might be taxable.

529 Plan Vs Iul

: Smaller plan face worths do not offer much benefit over normal UL insurance policies.: If the index goes down, no interest is credited to the cash money value.

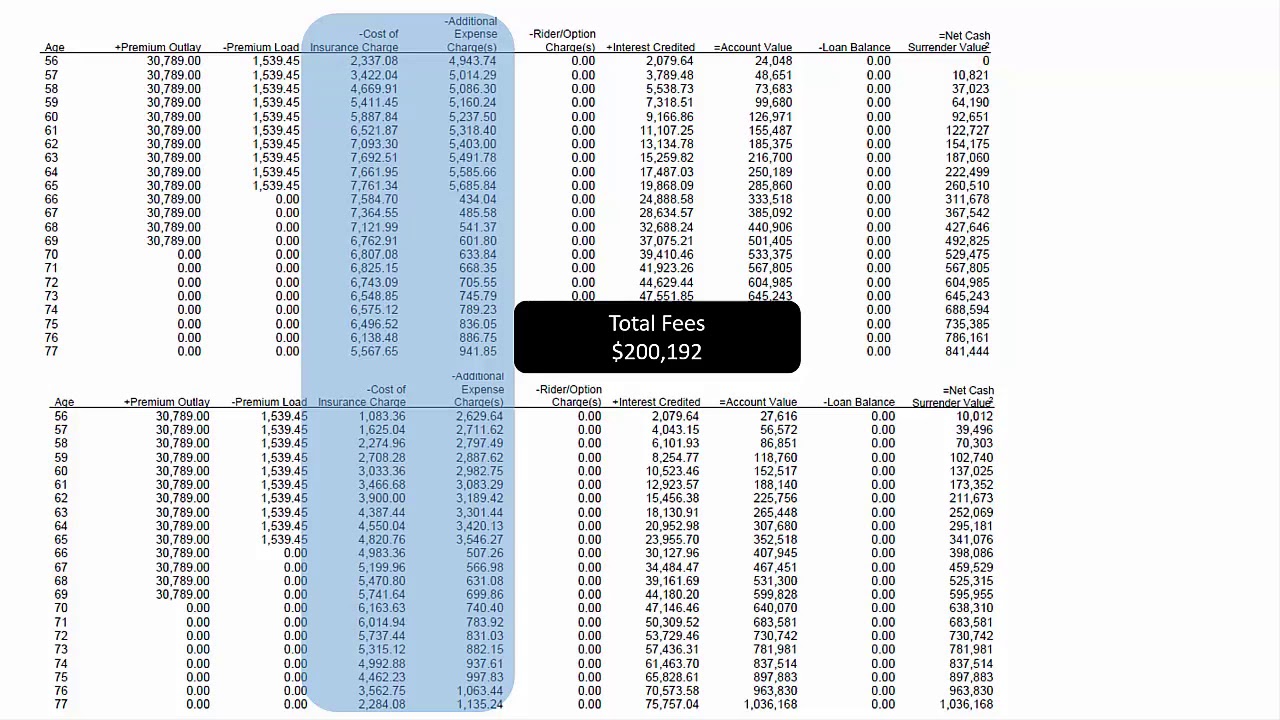

With IUL, the objective is to benefit from upward motions in the index.: Since the insurance provider just acquires options in an index, you're not directly spent in supplies, so you don't profit when business pay returns to shareholders.: Insurers cost fees for managing your money, which can drain pipes cash money worth.

For most individuals, no, IUL isn't better than a 401(k) in terms of saving for retirement. Many IULs are best for high-net-worth individuals seeking means to minimize their taxable earnings or those who have actually maxed out their other retired life options. For everyone else, a 401(k) is a far better investment automobile because it doesn't bring the high charges and premiums of an IUL, plus there is no cap on the amount you might gain (unlike with an IUL plan).

While you may not shed any kind of money in the account if the index drops, you won't earn passion. If the marketplace turns favorable, the profits on your IUL will not be as high as a regular investment account. The high cost of premiums and fees makes IULs expensive and considerably much less inexpensive than term life.

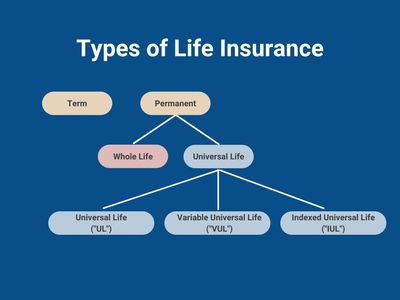

Indexed universal life (IUL) insurance coverage uses money value plus a survivor benefit. The cash in the money value account can make interest with tracking an equity index, and with some often alloted to a fixed-rate account. Indexed universal life plans cap how much cash you can collect (often at much less than 100%) and they are based on a perhaps unpredictable equity index.

Index Universal Life Insurance Quotes

A 401(k) is a much better choice for that objective because it doesn't carry the high costs and premiums of an IUL policy, plus there is no cap on the amount you might earn when spent. A lot of IUL policies are best for high-net-worth individuals seeking to lower their gross income. Investopedia does not offer tax obligation, financial investment, or economic services and suggestions.

FOR FINANCIAL PROFESSIONALS We have actually developed to supply you with the very best online experience. Your current web browser could restrict that experience. You might be making use of an old internet browser that's unsupported, or settings within your internet browser that are not compatible with our site. Please conserve yourself some frustration, and update your web browser in order to view our website.

Currently using an updated web browser and still having difficulty? Please give us a telephone call at for more assistance. Your existing browser: Spotting ...

Life Insurance Indexed Universal Life

When your picked index gains value, so too does your plan's cash money worth. Your IUL cash value will additionally have a minimal interest price that it will certainly always gain, regardless of market performance. Your IUL might additionally have a rates of interest cap. An IUL plan functions the exact same way as a conventional global life policy, with the exception of exactly how its money value gains interest.

Words Ending In Iul

If you're thinking about buying an indexed global life plan, very first talk with a monetary consultant that can clarify the subtleties and provide you an exact photo of the actual potential of an IUL policy. Make certain you understand just how the insurer will compute your rates of interest, revenues cap, and charges that could be examined.

Part of your premiums covers the policy price, while the rest enters into the cash money value account, which can grow based upon market performance. While IULs could seem eye-catching, they normally feature high charges and inflexible terms and are completely inappropriate for lots of capitalists. They can produce interest but also have the possible to lose money.

Below are some variables that you must consider when figuring out whether a IUL plan was right for you:: IULs are intricate financial products. Make certain your broker totally explained how they function, including the prices, financial investment risks, and charge frameworks. There are much less costly options offered if a death advantage is being sought by a capitalist.

Roth 401k Vs Iul

These can dramatically reduce your returns. If your Broker stopped working to provide a comprehensive explanation of the costs for the plan this can be a warning. Know abandonment fees if you determine to terminate the plan early.: The financial investment part of a IUL goes through market changes and have a cap on returns (meaning that the insurer receives the advantage of outstanding market performance and the financier's gains are capped).

: Ensure you were told concerning and are able to pay enough premiums to maintain the policy in pressure. It is critical to extensively research study and understand the terms, fees, and prospective risks of an IUL policy.

Traditional growth investments can commonly be paired with more affordable insurance coverage options if a survivor benefit is crucial to an investor. IULs are excluded from government policy under the Dodd-Frank Act, suggesting they are not overseen by the U.S. Securities and Exchange Commission (SEC) like stocks and alternatives. Insurance coverage representatives selling IULs are only needed to be accredited by the state, not to go through the exact same rigorous training as financiers.

Table of Contents

Latest Posts

Iul Scam

Iul Masticator

Iul Masticator

More

Latest Posts

Iul Scam

Iul Masticator

Iul Masticator